SkyCity Entertainment Group has revised its financial forecast for 2024, citing ongoing operational and economic challenges. The company announced a 20-25% reduction in EBITDA and a 15-20% decrease in net profit after tax (NPAT). These adjustments are due to regulatory pressures, market competition, and economic conditions impacting revenue streams. To mitigate these issues, SkyCity is implementing operational efficiency measures and exploring new revenue streams, including enhancing its digital presence. Despite current difficulties, these strategic initiatives aim to position SkyCity for long-term growth and stability.

SkyCity Entertainment Group Lowers Full-Year 2024 Financial Forecast Amid Ongoing Issues

SkyCity Entertainment Group has reduced its full-year guidance for both underlying group EBITDA and net profit after tax for the 2024 financial year amid several ongoing issues https://t.co/hzCg3j9V0u pic.twitter.com/a3MjkuX21G

Introduction: SkyCity's Financial Outlook For 2024

SkyCity Entertainment Group has announced a significant reduction in its financial forecast for the 2024 financial year. This news comes amid several ongoing issues that the company has been facing, leading to a downward revision of its full-year guidance for both underlying group EBITDA and net profit after tax (NPAT).

Underlying Factors Affecting SkyCity's Financial Performance

Operational Challenges

The operational challenges that SkyCity has been grappling with have put a strain on their financial outlook. According to CasinoALMA sources, these challenges include regulatory pressures, market competition, and disruptions in supply chains. These factors have contributed to a decline in the company’s revenue streams, thereby impacting their overall profitability.

Economic Conditions and Market Dynamics

Economic conditions and market dynamics have also played a pivotal role. The global economic slowdown, coupled with inflationary pressures, has affected consumer spending habits. This, in turn, has led to a decrease in demand for SkyCity’s entertainment and hospitality services. Additionally, market competition from other online casinos and entertainment providers has intensified, further impacting their market share.

Revised Financial Projections

EBITDA Reduction

SkyCity Entertainment Group’s revised financial projections indicate a substantial reduction in their EBITDA. The underlying group EBITDA is expected to decrease by approximately 20-25%, a significant drop from their initial forecasts. This reduction is attributed to the declining revenue and increased operational costs that the company has been forced to manage.

Net Profit After Tax (NPAT)

In addition to the EBITDA reduction, SkyCity has also lowered its forecasted NPAT. The revised NPAT is expected to be around 15-20% lower than previously anticipated. This revision reflects the combined impact of decreased revenues and heightened costs, as well as other macroeconomic factors affecting the business environment.

Strategic Response and Mitigation Measures

Operational Efficiency Initiatives

In response to these challenges, SkyCity Entertainment Group has initiated several operational efficiency measures aimed at reducing costs and improving financial performance. These measures include streamlining their operations, implementing cost-saving programs, and renegotiating supplier contracts to better manage expenses.

Innovation and Market Adaptation

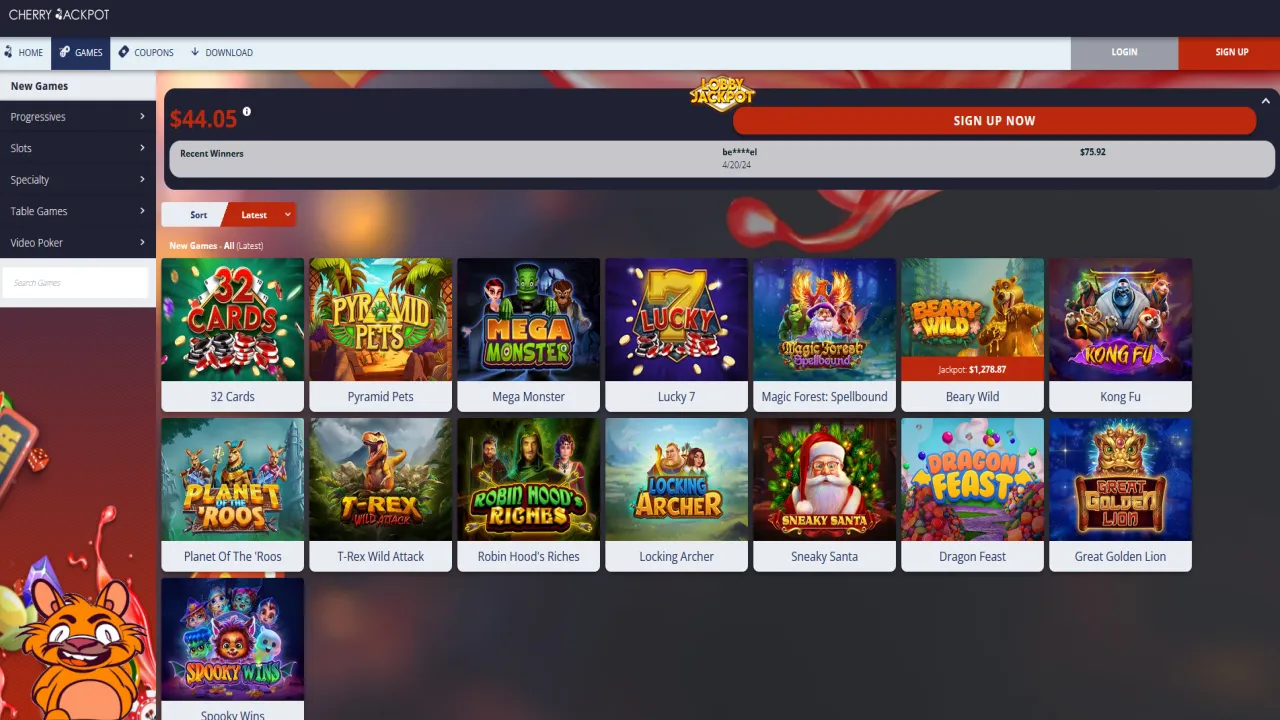

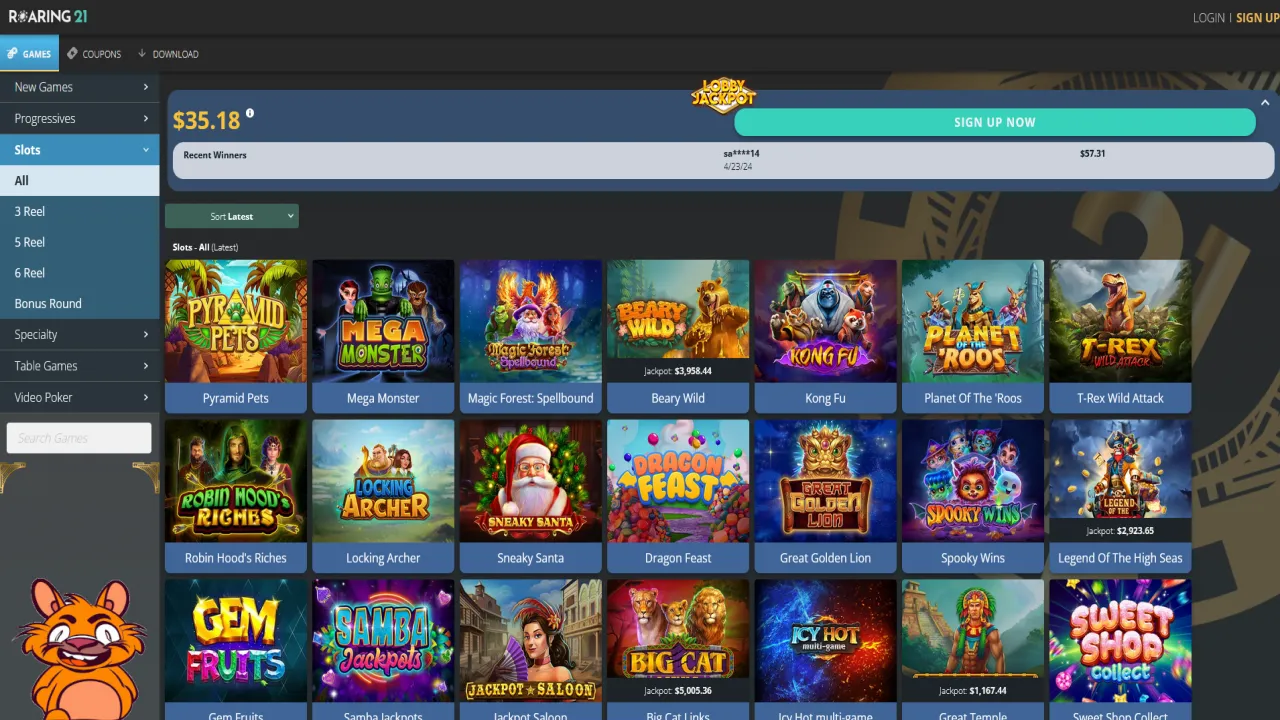

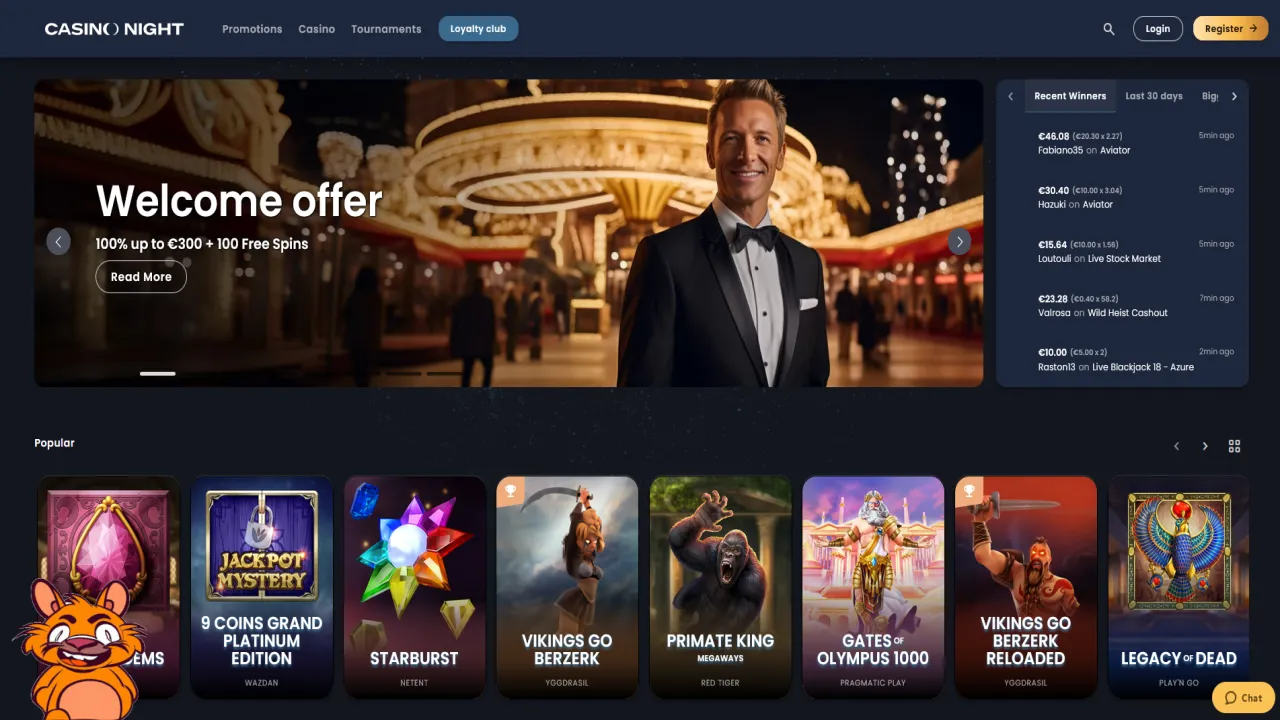

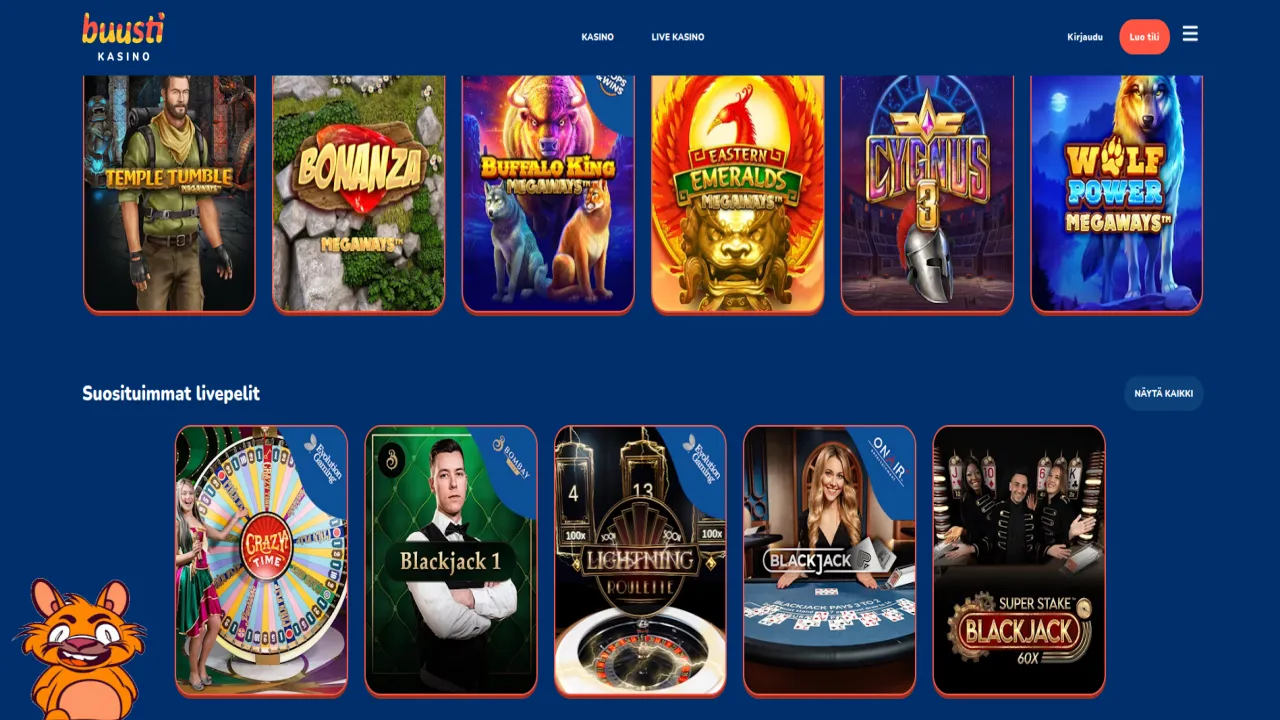

To stay competitive in a challenging market, SkyCity is also focusing on innovation and market adaptation. The company is exploring new revenue streams, including expanding their live casino offerings and enhancing their digital presence. These strategies are aimed at attracting a broader customer base and diversifying their revenue sources.

Industry Implications and Future Outlook

Impact on the iGaming Industry

The financial challenges faced by SkyCity Entertainment Group are reflective of broader trends in the iGaming industry. Many operators are experiencing similar pressures due to economic uncertainties and changing consumer behaviors. As an industry leader, SkyCity’s measures to address these challenges could pave the way for other companies to adopt similar strategies.

Long-Term Prospects

While the immediate outlook for SkyCity remains challenging, the company’s strategic initiatives could yield positive results in the long term. By focusing on operational efficiency and market adaptation, SkyCity aims to position itself for sustainable growth. Industry analysts believe that these efforts, coupled with a potential economic recovery, could help SkyCity and other operators in the sector to regain their financial stability.

CasinoALMA's Insight on SkyCity's Situation

At CasinoALMA, we monitor such developments closely to provide our readers with the most reliable and up-to-date news in the industry. SkyCity’s situation highlights the need for operators to remain agile and responsive to market changes. By leveraging innovative solutions and strategic planning, companies can navigate through challenging times and emerge stronger.

Conclusion: A Turning Point for SkyCity

In conclusion, SkyCity Entertainment Group’s decision to lower its financial forecast for 2024 reflects the significant challenges that the company is facing. However, with strategic initiatives focused on operational efficiency and innovation, SkyCity is taking proactive steps to mitigate these challenges and position itself for future growth. The broader iGaming industry will be watching closely to see how these measures play out and potentially follow suit.

For more insights and updates on the latest trends and developments in the online casino world, stay tuned to CasinoALMA. Whether you're looking for the best no deposit bonus deals or the latest industry news, CasinoALMA is your go-to source for trustworthy and comprehensive information.

Latest Developments and Future Trends

Regulatory Pressures

SkyCity Entertainment Group is currently facing significant regulatory pressures, which have had a considerable impact on its financial outlook. The Australian financial regulator, AUSTRAC, has imposed a hefty fine on the company for breaches of money laundering rules. This penalty, along with the costs of completing the delayed new hotel and convention center in Auckland, has further strained the company's financial resources.

According to CasinoALMA sources, SkyCity is due to pay AUSTRAC AUD 67 million next month, and it estimates an additional NZD 76 million to complete the Auckland project. Consequently, SkyCity has decided to withhold the next three dividend payments to shareholders and intends to resume them in the 2026 financial year.

This decision underscores the urgency of addressing regulatory and financial challenges. With pending regulatory reviews and potential duty expenses increases at the Adelaide casino, SkyCity’s financial landscape remains uncertain.

Additionally, the possibility of a temporary suspension of its operator's license at New Zealand casinos is looming, with a decision expected in August. These developments could add to the existing financial pressures, making it imperative for SkyCity to resolve regulatory matters promptly.

Impact of Economic Conditions

SkyCity attributes its financial challenges to a sluggish economy, high interest rates, and weak consumer spending. The company has observed a noticeable decline in consumer spending at its casinos, particularly in Auckland. Despite visitors, the reduced spending levels have significantly impacted the company’s revenue. Further exacerbating the situation is the lack of growth in tourist spending on entertainment, which has been affected by anti-money laundering crackdowns and hefty fines on both the Auckland and Adelaide operations.

The economic slowdown and high interest rates, especially for home loans, have contributed to the overall reduced consumer spending. The company has suspended its dividend payout for the year ending June and all of 2024-25, with the expectation to resume in 2026.

Financial Projections for 2024-25

SkyCity has downgraded its earnings forecast for the year ending June, expecting a full-year underlying profit decline of between NZD 10 million and NZD 25 million from an earlier forecast of NZD 280 million to NZD 285 million. Net profit is likely to decrease by between NZD 5 million and NZD 10 million, resulting in a range of NZD 120 to NZD 125 million.

The financial outlook for the 2025 financial year remains cautious, with SkyCity estimating an underlying profit of between NZD 250 million and NZD 270 million, including potential one-time costs of about NZD 20 million to NZD 30 million. These projections highlight the ongoing financial strain and the need for effective strategic measures.

SkyCity's strategic initiatives, including operational efficiency programs and innovation efforts, aim to address these financial challenges. By diversifying revenue streams, enhancing digital presence, and improving operational efficiency, SkyCity is positioning itself for a more resilient future.

This image depicts the financial challenges faced by SkyCity Entertainment Group, including a downward trend in EBITDA and NPAT, alongside symbols of operational challenges and innovation efforts. The stormy sky symbolizes the ongoing issues, while light bulbs and cogwheels represent the company's strategic responses.

Strategic Measures and Future Prospects

Operational Efficiency

SkyCity's strategic response to the financial challenges includes a strong focus on operational efficiency. The company has implemented several measures to streamline operations and reduce costs. These initiatives include renegotiating supplier contracts, optimizing resource allocation, and implementing cost-saving programs.

By enhancing operational efficiency, SkyCity aims to improve its financial performance and mitigate the impact of ongoing challenges. The company's efforts in this area are expected to yield significant cost savings and operational improvements over the coming years.

Innovation and Market Adaptation

Innovation and market adaptation are key components of SkyCity’s strategy to overcome financial challenges. The company is actively exploring new revenue streams and expanding its offerings in areas such as live casino and digital gaming. By leveraging innovative solutions and adapting to changing market dynamics, SkyCity aims to attract a broader customer base and enhance its competitive position.

SkyCity's focus on digital transformation and innovation is expected to drive growth and diversification. The company's efforts to enhance its digital presence, improve customer experiences, and explore new market opportunities are critical to its long-term success.

Furthermore, SkyCity’s emphasis on innovation extends to its entertainment and hospitality services. By offering unique and engaging experiences, the company aims to attract more visitors and increase customer loyalty.

Conclusion: Navigating Financial Challenges and Future Growth

SkyCity Entertainment Group's decision to lower its financial forecast for 2024 highlights the significant challenges the company is facing. However, with strategic initiatives focused on operational efficiency, innovation, and market adaptation, SkyCity is taking proactive steps to navigate these challenges and position itself for future growth.

While the immediate financial outlook remains challenging, the company’s efforts to improve operational efficiency, explore new revenue streams, and enhance digital presence are expected to yield positive results in the long term. Industry analysts believe that these strategic measures, coupled with a potential economic recovery, could help SkyCity regain financial stability and drive sustainable growth.

As the iGaming industry continues to evolve, SkyCity's approach to addressing financial challenges and leveraging strategic initiatives serves as a model for other operators. By staying agile, innovative, and responsive to market changes, companies in the industry can overcome challenges and achieve sustained success.

For more insights and updates on the latest trends and developments in the iGaming industry, stay tuned to CasinoALMA. Whether you're looking for the latest industry news, best no deposit bonus deals, or comprehensive information on online casinos, CasinoALMA is your trusted source for reliable and up-to-date information.