SkyCity Entertainment Group has adjusted its fiscal year earnings guidance, now projecting full-year EBITDA between NZ$280 million and NZ$285 million. Market pressures and strategic company decisions are cited as reasons. Alongside, SkyCity has suspended dividends to maintain liquidity, affecting shareholder confidence. Analysts have mixed reactions but acknowledge the long-term focus. Despite challenges, SkyCity remains strong in the iGaming sector, exploring new growth opportunities. The casino industry is dynamically responding to SkyCity's and other notable casinos' market strategies, offering exciting bonuses and promotions to iGaming enthusiasts.

SkyCity Revises Earnings Guidance and Suspends Dividends

In a significant development, SkyCity Entertainment Group, a key player in the casino and entertainment sector, has announced a revision of its earnings guidance for the fiscal year. The full-year EBITDA is now projected to be between NZ$280 million and NZ$285 million, equivalent to approximately US$176.6 million. This adjustment is attributed to various market pressures and strategic decisions within the company, showcasing a cautious approach amidst challenging economic conditions.

Financial Adjustments Amid Market Challenges

SkyCity’s decision to revise its earnings guidance comes as no surprise, given the fluctuating market conditions and the broader economic landscape. According to CasinoALMA sources, the decision to also suspend dividends reflects a cautious approach by the company to maintain liquidity and ensure financial stability. This suspension will remain in place throughout the remainder of 2024 and 2025, with dividends expected to resume in FY26, contingent on satisfactory market conditions.

Implications for Shareholders

The suspension of dividends is a significant move that impacts shareholders directly. Dividend payments are often seen as a reward for investor loyalty, and their suspension can sometimes trigger uncertainty among stakeholders. However, SkyCity's strategic choice is aimed at fortifying the company’s financial health during these challenging times. The company emphasizes that maintaining “prudent levels of committed liquidity headroom” with respect to its Debt/EBITDA covenant of 3.75x within its financing agreements is crucial, particularly with significant expenditures looming, such as the AU$67 million AUSTRAC civil penalty for AML failures at SkyCity Adelaide.

Market Reactions and Analyst Perspectives

Market analysts have responded with mixed reviews to SkyCity's adjustments. Some view the revised earnings guidance and suspended dividends as prudent steps. According to industry experts at CasinoALMA news, the company is prioritizing long-term sustainability over short-term gains. Others, however, express concerns about the potential negative impact on investor confidence. The company's shares experienced a notable decline following the announcement, reflecting the market’s immediate reaction to the news.

SkyCity's Strategic Positioning in the iGaming Sector

Despite these adjustments, SkyCity continues to be a prominent name in the iGaming and entertainment industry. The company’s strategic positioning remains robust, capitalizing on its well-established brand and extensive market presence in regions such as New Zealand and other parts of the Asia-Pacific. The anticipated delay and expenditure for the New Zealand International Convention Center also underline the company's commitment to long-term investments and infrastructural growth.

Future Outlook for SkyCity

Looking ahead, SkyCity plans to navigate market uncertainties by leveraging its core strengths and exploring new growth opportunities. The management remains optimistic about the company’s ability to rebound and create value for its stakeholders in the long run. They highlight ongoing efforts to address AML and CTF compliance risks and anticipate further improvement in these areas. Additionally, increased focus on pre-opening operational costs for key projects and preparing for online gaming regulation in New Zealand speaks volumes of their proactive strategic approach.

A financial analyst closely examines a bar chart showing SkyCity's projected earnings. The chart displays the revised earnings guidance with bars indicating NZ$280 million to NZ$285 million. In the background, the subtle presence of a casino floor blends the entertainment aspect with the financial theme.

Casino Industry Reactions

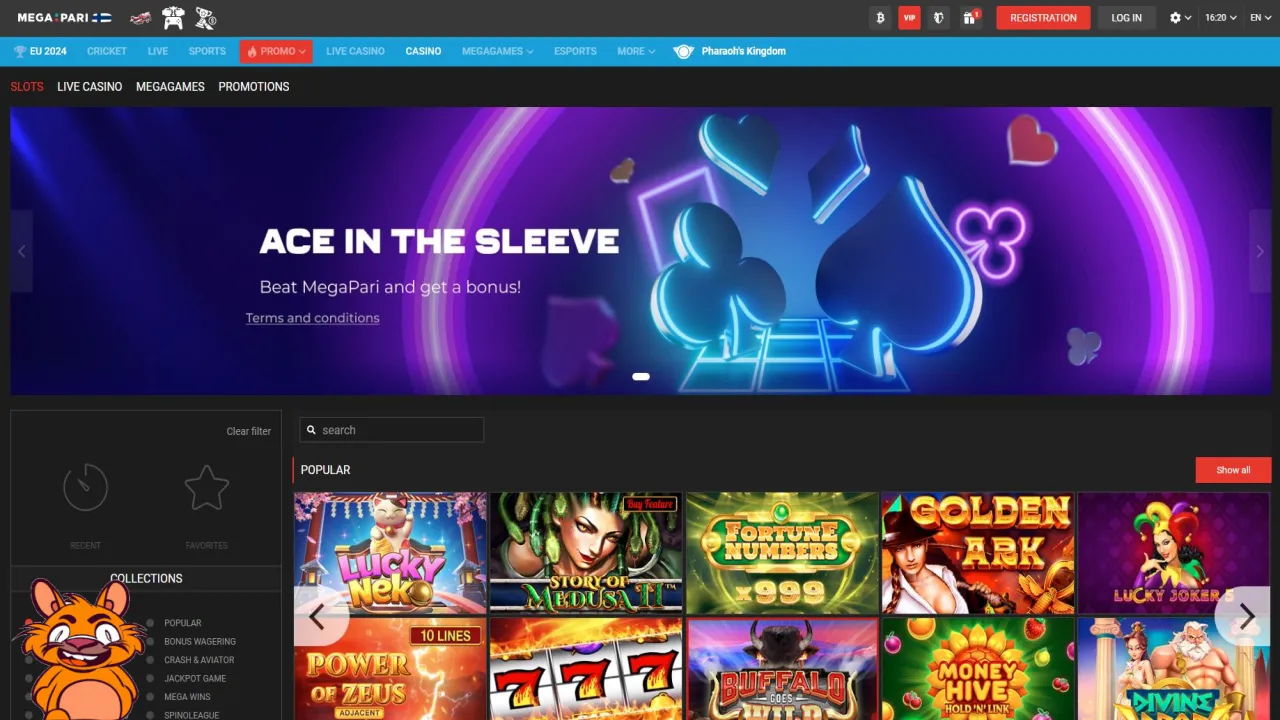

The broader casino and entertainment industry has been closely monitoring SkyCity’s financial moves. With a shifting landscape, companies are constantly adapting to new challenges and opportunities. This includes exploring innovative approaches, such as incorporating cutting-edge technology to enhance customer experiences in live casinos. The industry has also seen increased emphasis on regulatory compliance and market adaptation strategies, which could serve as models for others to emulate.

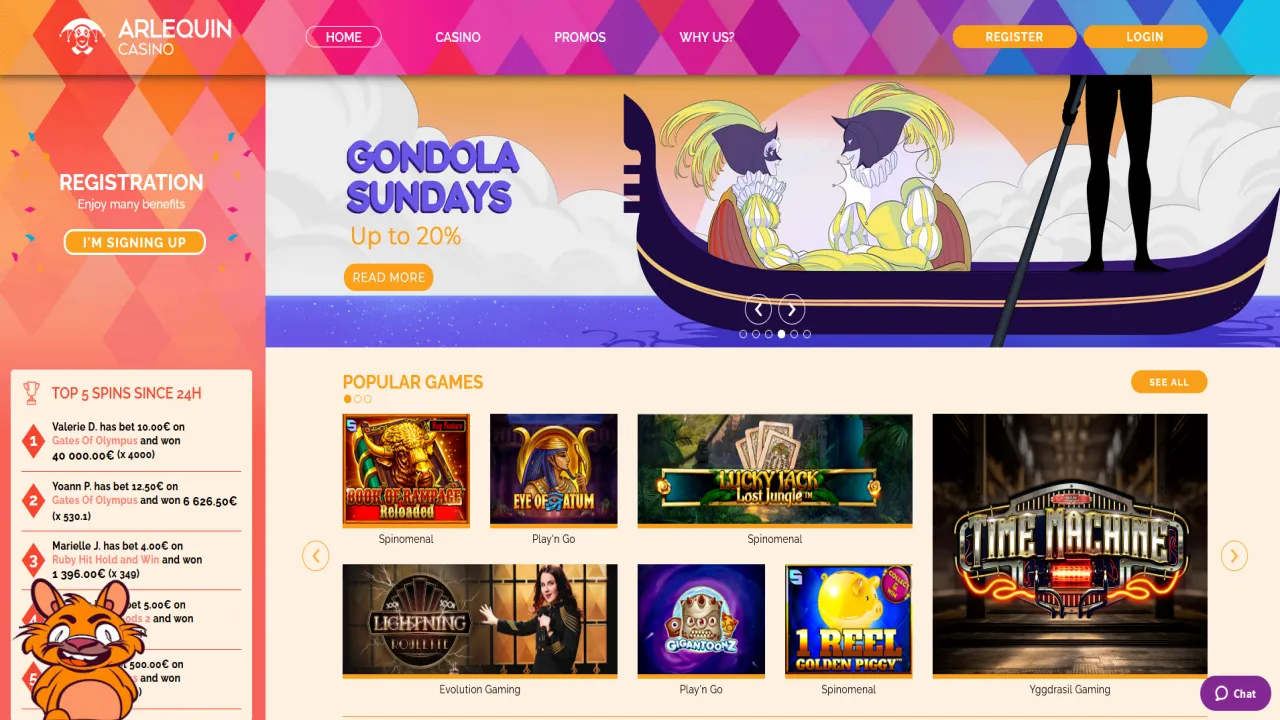

Spotlight on Reputed Casinos

As the industry evolves, the performance of other notable casinos also comes under the spotlight. For instance, Monro, known for its dynamic offerings, continues to attract a growing clientele. Similarly, JustCasino has been making waves with its generous bonus deals and top-notch game selections. The unique characteristics and approaches by different casinos contribute to a vibrant and competitive market. Casinos like Rebellion and Azur Casino have also carved a niche for themselves, offering exceptional gaming experiences and innovative features.

Impact on iGaming Enthusiasts

For iGaming enthusiasts, the updates and trends in the industry are crucial. Platforms like CasinoALMA provide comprehensive information, reviews, and updates to keep players informed. Whether it’s exploring new bonus deals or understanding the latest developments in favorite online casinos, staying informed is key. This helps players make well-informed decisions about where to invest their time and money.

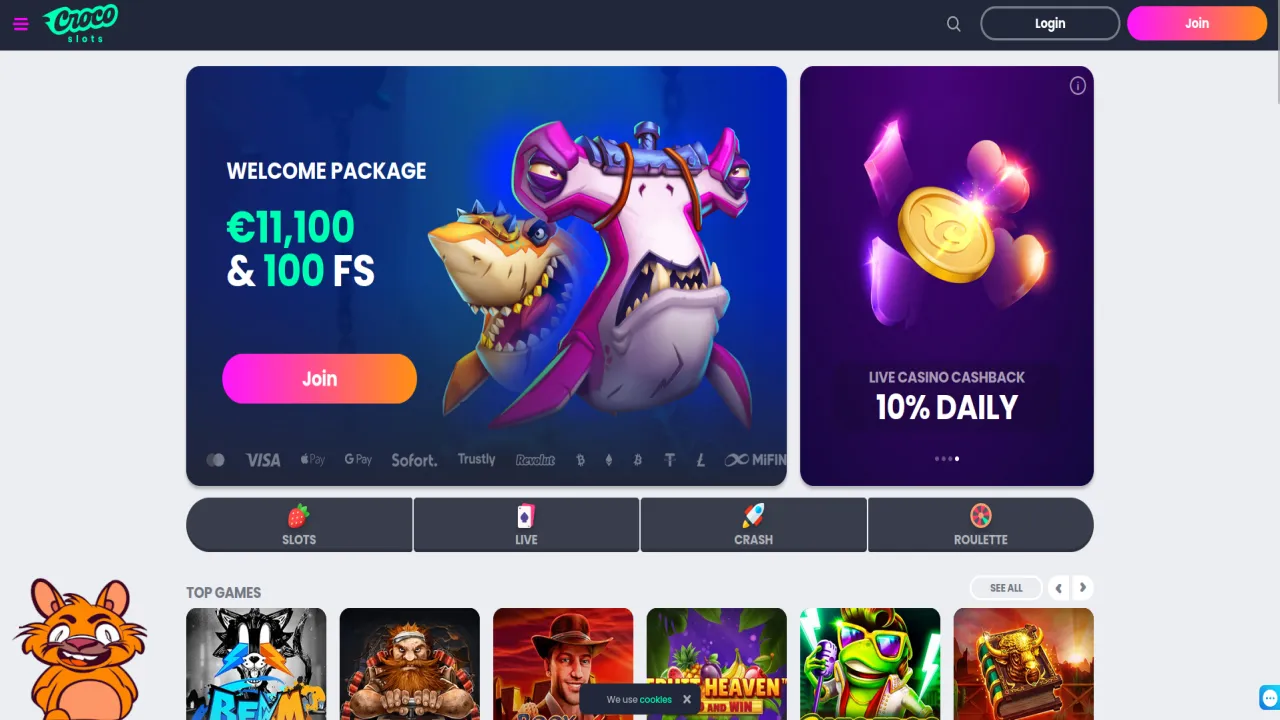

Exciting Promotions and Bonus Offerings

As players look for the best value, no deposit bonuses and other promotional offers become highly attractive. Casinos like LuckyDreams and Lataamo are known for their exceptional bonuses that appeal to both new and seasoned players. These promotions not only attract new players but also help retain existing ones, fostering a loyal customer base.

Conclusion

SkyCity's updated earnings guidance and the suspension of dividends are reflective of current market challenges and the company's strategic priorities. As the casino industry continues to evolve, staying informed about these changes is crucial for players, investors, and stakeholders alike. The broader impact on the industry highlights the interconnectedness of market players and the collective effort required to navigate such complex landscapes.

For the latest updates on the iGaming industry, including reliable casino reviews, bonus deals, and expert insights, visit CasinoALMA, the leading online casino database for trusted information and reviews. Keeping up with current trends ensures that players and stakeholders are always in the loop, making well-informed decisions that can positively influence their gaming and investment strategies.