The Indian government is considering a tax relief proposal for the online gaming industry through an amendment to the Goods and Services Tax (GST). This move aims to reduce the current 28% GST rate, which many believe hinders sector growth. Lower taxes could encourage investment, creating jobs and making India more competitive globally. Stakeholders, including major game providers, are optimistic, anticipating benefits like reduced operational costs and more attractive player promotions. The proposal could transform India into a significant player in the global online gaming market.

Indian Government Mulls Tax Relief for Online Gaming Industry

According to CasinoALMA sources, the Indian government is considering providing some tax relief to the country’s online gaming industry through a proposed amendment to the Goods and Services Tax (GST). This move is seen as a significant stride towards revitalizing the online gaming sector, which has been grappling with high taxation rates.

Implications of the Proposed GST Amendment

The proposed amendment aims to ease the financial burden on online gaming operators, thereby fostering growth and innovation within the sector. Currently, online gaming companies are subjected to a GST rate of 28%, which many industry stakeholders believe is excessively high and detrimental to the industry's growth.

Industry experts argue that reducing the GST rate could lead to increased investment in the online gaming market, creating more job opportunities and boosting the economy. Additionally, this tax relief is expected to make the Indian online gaming industry more competitive on a global scale.

Why Tax Relief Matters for Online Gaming

Online gaming has seen an exponential rise in popularity, especially during the COVID-19 pandemic, when people turned to digital entertainment as a means of maintaining social connections and alleviating boredom. Despite this surge in demand, the industry has struggled with high operational costs primarily due to steep taxation policies.

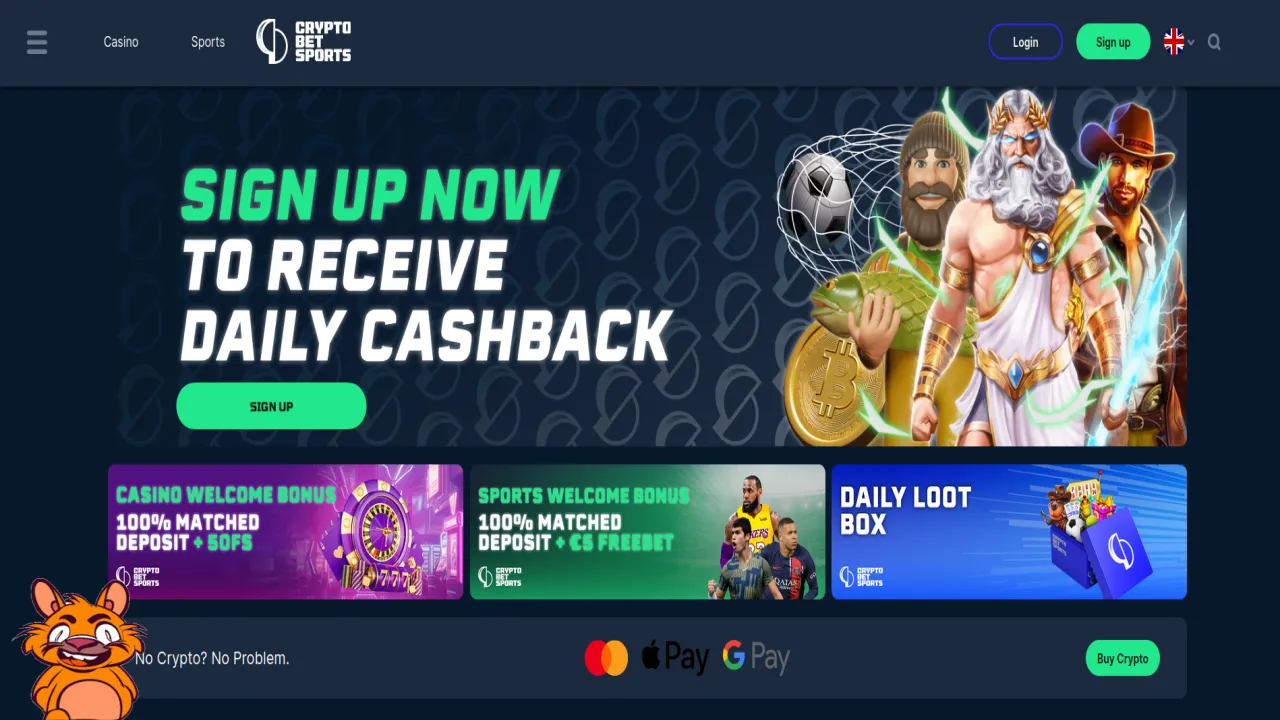

According to sources within CasinoALMA, tax relief would not only benefit existing players in the market but also encourage new entrants, leading to a more diverse and innovative gaming landscape.

Stakeholder Reactions and Industry Impact

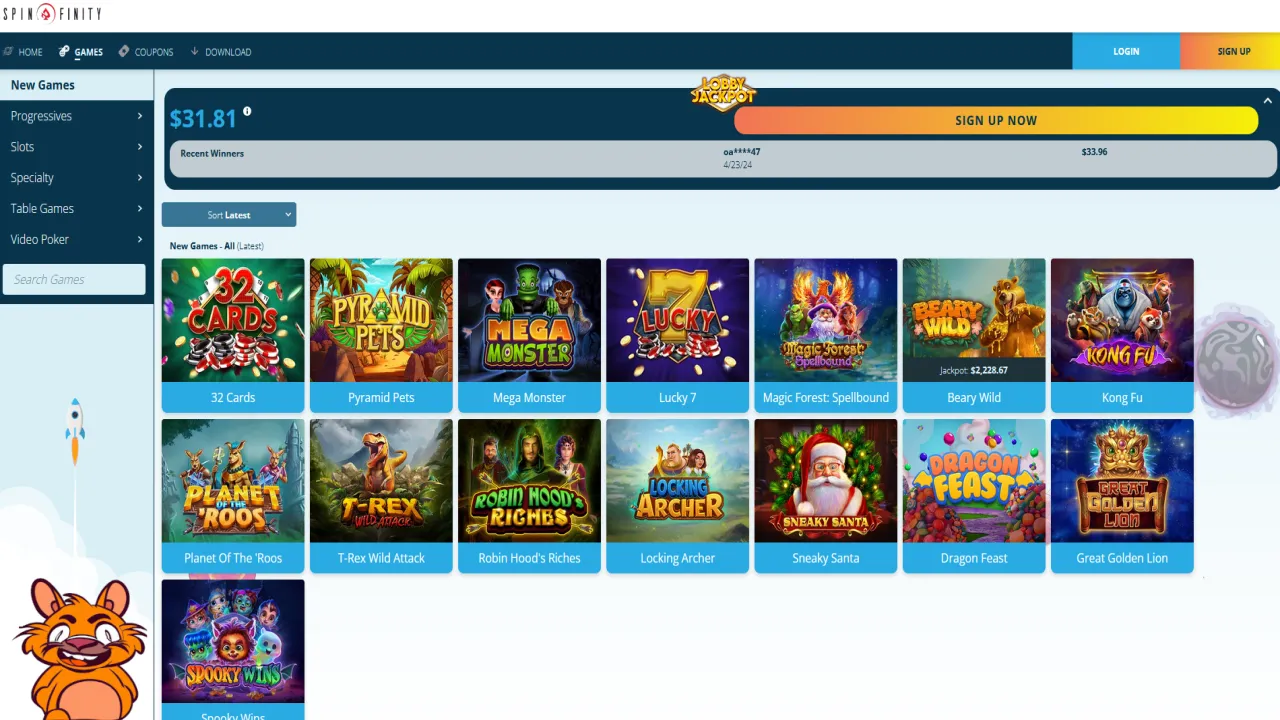

The proposed GST amendment has been met with enthusiasm from multiple stakeholders within the online gaming industry. Leading game providers such as NetEnt, Playtech, and Microgaming are hopeful that the tax relief will reduce operational costs and increase profit margins.

Online gaming operators like Neon54 and MyEmpire have also expressed their optimism, noting that lower tax rates would enable them to offer more competitive bonuses and promotions to players. For instance, the much sought-after no deposit bonus offers could become more frequent and generous.

The Future of Online Gaming in India

Looking ahead, the proposed GST amendment could mark the beginning of a new era for the Indian online gaming industry. By making the market more lucrative for investors and operators, the Indian government is poised to transform the nation into a global online gaming hub.

Moreover, industry leaders like Betsoft, Push Gaming, and Red Tiger are likely to take increased interest in the Indian market, bringing their high-quality games and innovative solutions to Indian players.

Challenges and Considerations

Despite the positive outlook, the proposed tax relief is not without its challenges. Regulatory bodies and policymakers must carefully balance economic incentives with responsible gaming measures. Ensuring player protection and preventing gambling addiction will remain critical issues that need addressing alongside tax reforms.

Additionally, the Indian online gaming industry will need to navigate complex legal landscapes and ensure compliance with both national and international regulations to fully capitalize on the benefits of the proposed GST amendment.

Global Reactions to India's Tax Relief Proposal

The international gaming community is closely watching India's move towards tax relief. Countries with burgeoning online gaming markets, like the UK and the US, have implemented similar measures to stimulate growth. Indian policymakers are likely drawing inspiration from these successful examples to craft a more sustainable tax framework for their own market.

According to CasinoALMA Germany sources, several European game providers are considering expanding their operations into India if the tax amendment goes into effect. This could lead to a more vibrant and competitive gaming ecosystem, benefiting players with a wider variety of high-quality gaming options.

Conclusion: A Promising Future for Indian Online Gaming

In summary, the proposed GST amendment presents a golden opportunity for the Indian online gaming industry to overcome its current challenges and pursue sustainable growth. By reducing tax burdens, attracting investments, and fostering innovation, India is on the verge of establishing itself as a key player in the global online gaming arena.

For the latest updates on the Indian government's GST amendment and its impact on the online gaming industry, stay tuned to CasinoALMA. Your leading source for trustworthy online casino reviews, bonus deals, and the most recent and reliable iGaming news.

The Indian government is considering providing some tax relief to the country’s online gaming industry, with a new proposed amendment to the Goods and Services Tax (GST).

— Asia Gaming Brief (@agbrief) June 20, 2024