Brazil's gambling market opening has been delayed as authorities require more time to review license applications. Operators now have until December 31 to meet regulatory requirements. This extension provides additional preparation time but also delays market entry and revenue generation. While experts see opportunities for better preparation, there are concerns over financial strains from the delay. Companies like Microgaming and Pragmatic Play plan to use this time to enhance their offerings and align with Brazilian regulations, aiming to offer a superior and compliant gaming experience once the market opens.

Brazil's Gambling Market Opening Delayed

The launch of Brazil's new gambling market has encountered another delay as more time is required to review license applications. According to CasinoALMA sources, operators now have until December 31 to comply with the necessary regulatory requirements.

Extended Deadline for License Applications

Initially, Brazil's gambling authorities aimed to open its market sooner, but the complexity of processing numerous license applications has pushed back the deadline. The revised date now gives operators additional months to ensure they meet all compliance standards. This shift in timeline is crucial for both local and international iGaming operators intending to penetrate Brazil's burgeoning gambling sector. It allows them more time to refine their applications and ensure they adhere to Brazil's stringent regulatory framework.

What This Means for Operators

For operators, this delay represents a mix of challenges and opportunities. While the extended timeline means more preparation time, it also signifies delays in market entry and revenue generation. Companies like NetEnt and Playtech are likely to use this extra period to build more robust operational strategies for the Brazilian market.

This delay also gives a window to smaller operators who might have been struggling to meet the initial deadlines. This additional time can be a game-changer for them, allowing for more meticulous planning and execution.

Expert Opinions and Industry Reactions

Industry experts have mixed feelings about the delay. On one hand, Antony Waller, an analyst from Global Gambling Insights, stated, “The delay, albeit frustrating for some, provides an opportunity for operators to present flawless applications, ensuring a more stable market launch.”

Conversely, there are concerns about how this impacts the momentum that Brazil's gambling market was building. “Operators were gearing up for an earlier launch and have invested accordingly. This delay could lead to some financial strain,” noted Lara Müller, CEO of Müller Consultancies.

Global Market Implications

Brazil's delayed market opening is also catching eyes on the global front. As one of the largest untapped markets, Brazil's gambling sector is highly anticipated. Companies globally are watching closely, ready to enter what is predicted to be a significant revenue source in Latin America's gambling landscape.

More days are needed to assess license applications to participate in Brazil’s new gambling market, pushing back the market’s opening. Operators will have until Dec. 31 to comply.

For a FREE sub to GGB NEWS use code GGB180https://t.co/qjA8wbBxQX pic.twitter.com/Bv8uu0AoU8— GGB (@GlobalGamingBiz) June 6, 2024

Preparing for the Brazilian Market

Operators and suppliers are expected to maximize this time to align themselves better with Brazilian regulations. Leading companies like Microgaming and Playson will likely leverage their global expertise to create tailored solutions for Brazilian patrons.

Enhanced Services and Offerings

Additionally, operators are focusing on enhancing their deposit methods, improving customer support, and curating specific game libraries. Companies such as Pragmatic Play and Red Tiger are expected to offer unique gaming experiences to cater to the local taste.

Global Reaction to Brazil's Gambling Market Delays

The global iGaming community has closely monitored the developments in Brazil. The dynamic Brazilian market poses a lucrative opportunity, prompting significant interest from global giants. Key players like NetEnt and Playtech have expressed their strategic plans to capitalize on the Brazilian craze for online casinos and sports betting. According to industry insiders, the delay has given these companies a chance to recalibrate their entry strategies, ensuring they meet all compliance requirements to gain a robust foothold in Brazil.

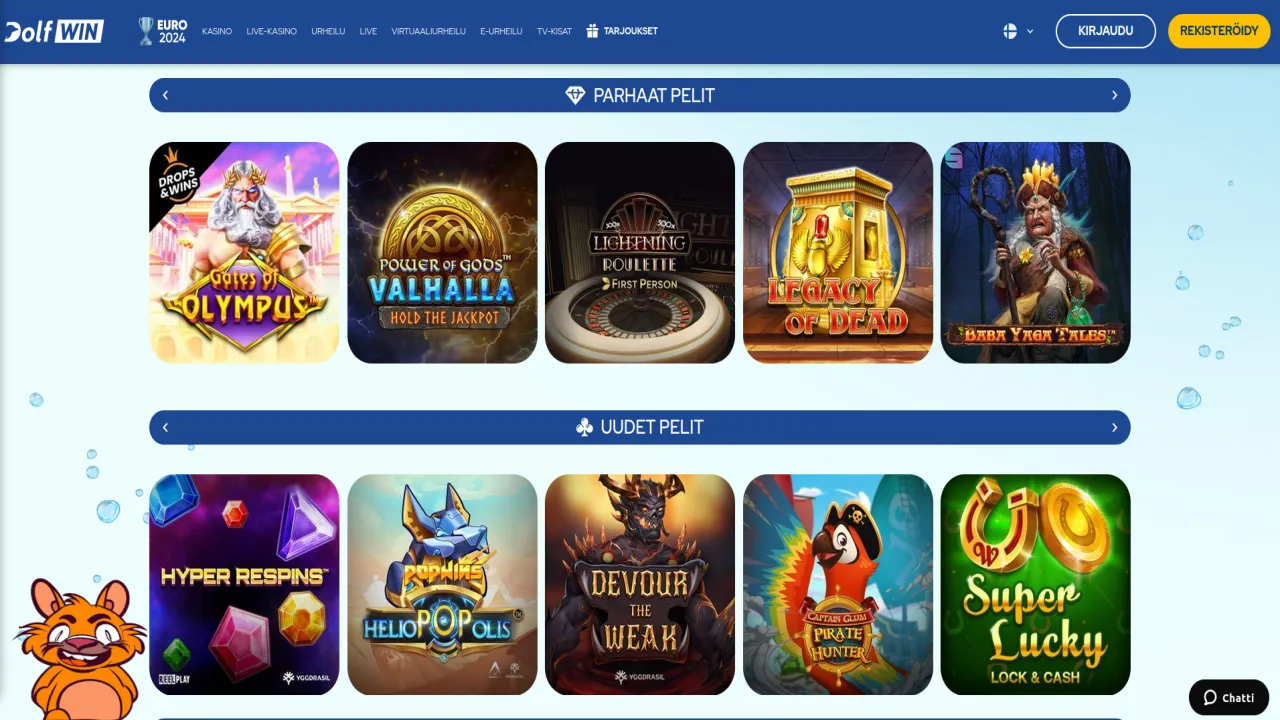

The image highlights the extended deadline of December 31 for Brazil's gambling market launch, along with iconic Brazilian elements such as the flag and landmarks, combined with gambling paraphernalia like poker chips and cards, symbolizing the delayed yet highly anticipated market opening.

Regulatory Impact on Brazilian iGaming Ecosystem

Pioneering the regulatory framework, the Brazilian government has imposed a set of stringent regulations that have left operators to rethink their strategies. The Prizes and Betting Secretariat (SPA) meticulously scrutinizes each application, adding another layer of diligence to the licensing process. Fabio Kujawski from Mattos Filho noted that Ordinance No 827 set a December 31 deadline for compliance, after which operators could face severe penalties.

This regulatory landscape is prompting operators to ensure thorough adherence to anti-money laundering (AML) protocols and fraud prevention measures. The market is anticipated to kick off with a solid legal backbone, ensuring a fair, transparent, and secure gambling environment for Brazilian players.

Microgaming and Playson: Entry Strategies of Key Players

Both Microgaming and Playson are gearing up to dominate the Brazilian gambling scene. Microgaming, with its extensive global clout, plans to deploy a range of localized games catering to Brazilian preferences, while ensuring compliance with all regulatory requirements.

Playson's approach is equally dynamic, focusing on a blend of innovative gaming solutions and superior customer service. Through localized content and advanced technological solutions, Playson aims to carve out a significant share in Brazil’s nascent market, which estimates suggest could be worth billions over the next few years.

Detailed Look at Brazil's Gambling Laws and Regulations

Brazil’s Law No. 14,790 has significantly altered the betting landscape, especially for fixed-odds betting. This law, passed in December 2023, has attracted giants like NetEnt and Playtech to Brazilian shores. However, the detailed compliance requirements, including a BR$30 million (US$6.1 million) license fee valid for five years, mean that only well-capitalized operators can afford to enter the market initially.

The Money Laundering and Terrorism Financing protocols placed under Article 35 of Bill 3,626/2023 further tighten the noose around compliance, making it imperative for operators to demonstrate adherence to KYC and AML protocols rigorously. This translates into a safer and more secure betting environment for the Brazilian public, aligning with the global trend of regulatory tightening.

Impact of the Incentives Ban

The SPA's recent prohibition of wagering incentives like bonuses and free bets marks a pivotal shift in the Brazilian gambling industry. By discouraging impulsive betting behaviors through Chapter Two, Sub-section four of the SPA's framework, the government aims to foster responsible gambling. The mandate for electronic transfers within a 120-minute window post-betting event completion also adds a layer of transparency and traceability to all transactions.

Operators must rethink their customer acquisition and retention strategies without relying on traditional bonuses. This strategic pivot is likely to see a surge in innovation around product offerings and customer engagement tactics, which could ultimately benefit the players through better gaming experiences.

Forecast: Brazil's Gambling Market Revenue Potential

Despite delays, the future looks promising for Brazil's gambling market. Analysts predict a swift rise in revenue once the market goes live, thanks to Brazil's sizable population and high internet penetration rates. The potential market value is estimated to skyrocket, drawing more operators into this burgeoning sector.

Chris Lambert, a market analyst, remarked, "The Brazilian gambling market is poised for exponential growth. With strategic planning and adherence to tight regulatory standards, operators can expect significant returns on investment." This upbeat outlook is echoed by many within the industry, seeing Brazil's regulated market as a beacon for Latin American gambling.

Going Forward: Final Preparations

As operators finalize their applications and ramp up preparations, the focus is on delivering a refined customer experience. Enhancing deposit methods, streamlining sports betting platforms, and optimizing customer support are top priorities.

With the deadline set for December 31, operators like Pragmatic Play and Red Tiger are fine-tuning their offerings to cater to Brazilian tastes. This period of preparation is seen not just as a regulatory hurdle but as an opportunity to debut a well-rounded, compliant, and engaging gambling platform.

Concluding Thoughts: The Wait for a Better Market

In conclusion, while the delay in Brazil's gambling market opening might be seen as a setback, it is an essential step to ensure the market is launched on solid ground. The extended timeline allows for more thorough preparation, ultimately aiming for a sustainable and thriving gambling industry in Brazil. The proactive approach in dealing with compliance standards sets a precedent that is likely to be emulated globally.

Stay tuned for more updates on this and other iGaming news from CasinoALMA, the leading online casino database globally. Visit CasinoALMA in different languages, including our Finnish portal CasinoALMA.fi, the Swedish version at CasinoALMA.se, or for German readers at CasinoALMA.de.