BIR Commissioner Romeo Lumagui Jr. stresses due process and warns of potential criminal charges for tax evasion if reported income doesn’t match property values. This highlights the importance of accurate financial reporting, especially for the iGaming industry. Online casinos must ensure transparent accounting practices to avoid legal repercussions. Leveraging technology and robust auditing can help maintain compliance, ensuring both regulatory adherence and user trust.

BIR Commissioner Highlights Due Process and Potential Criminal Charges in Tax Evasion Cases

The Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. has taken a significant step in ensuring adherence to due process within the realms of tax compliance. In a statement, Lumagui emphasized the vital importance of accurately reporting income, and the serious repercussions for failing to do so.

BIR Commissioner Romeo Lumagui Jr. emphasizes adherence to due process. In cases where reported income to the BIR doesn’t align with the accumulated property values in the same taxable periods, potential criminal charges for tax evasion may ensue.

— Asia Gaming Brief (@agbrief) June 11, 2024

Ensuring Compliance: A Critical Issue for the iGaming Industry

According to sources, the BIR’s recent focus on aligning reported incomes with accumulated property values has significant implications for the online gaming industry and other related sectors. In instances where discrepancies are found in their financial reports, businesses could face potential criminal charges for tax evasion. This has put the spotlight on the necessity for the iGaming businesses to maintain transparent and accurate accounting practices.

Impact on Online Casinos and Game Providers

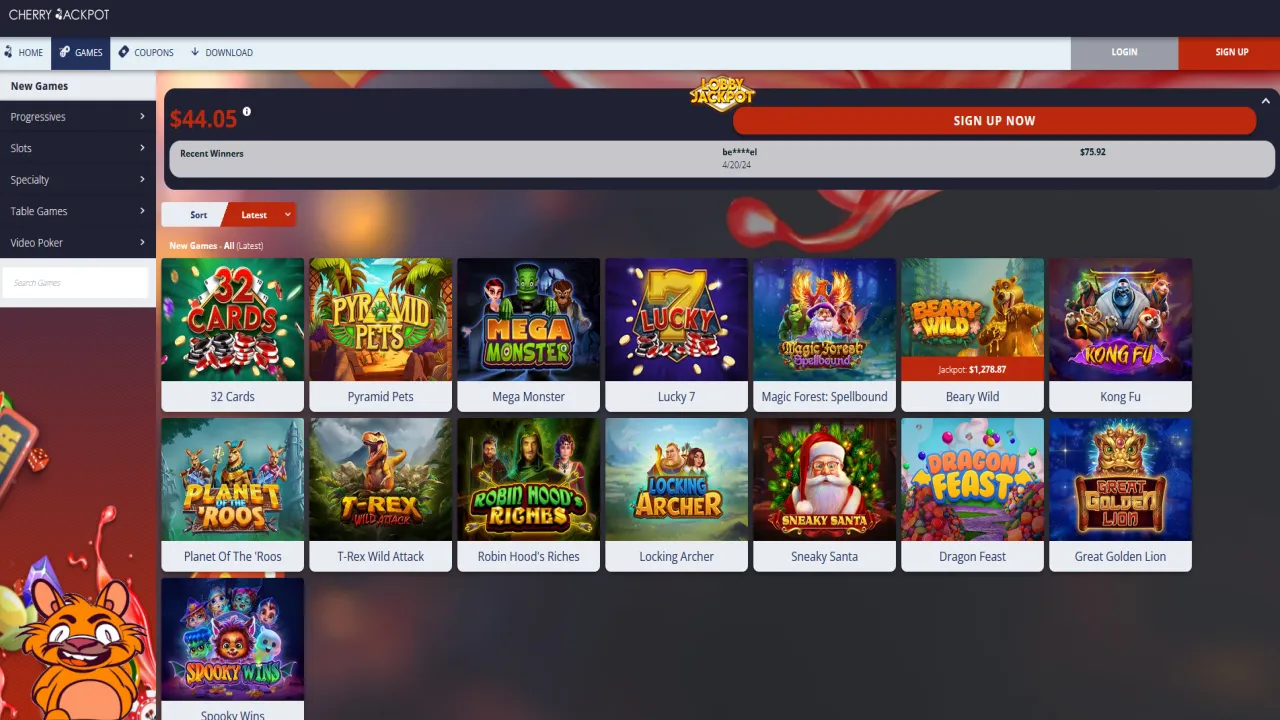

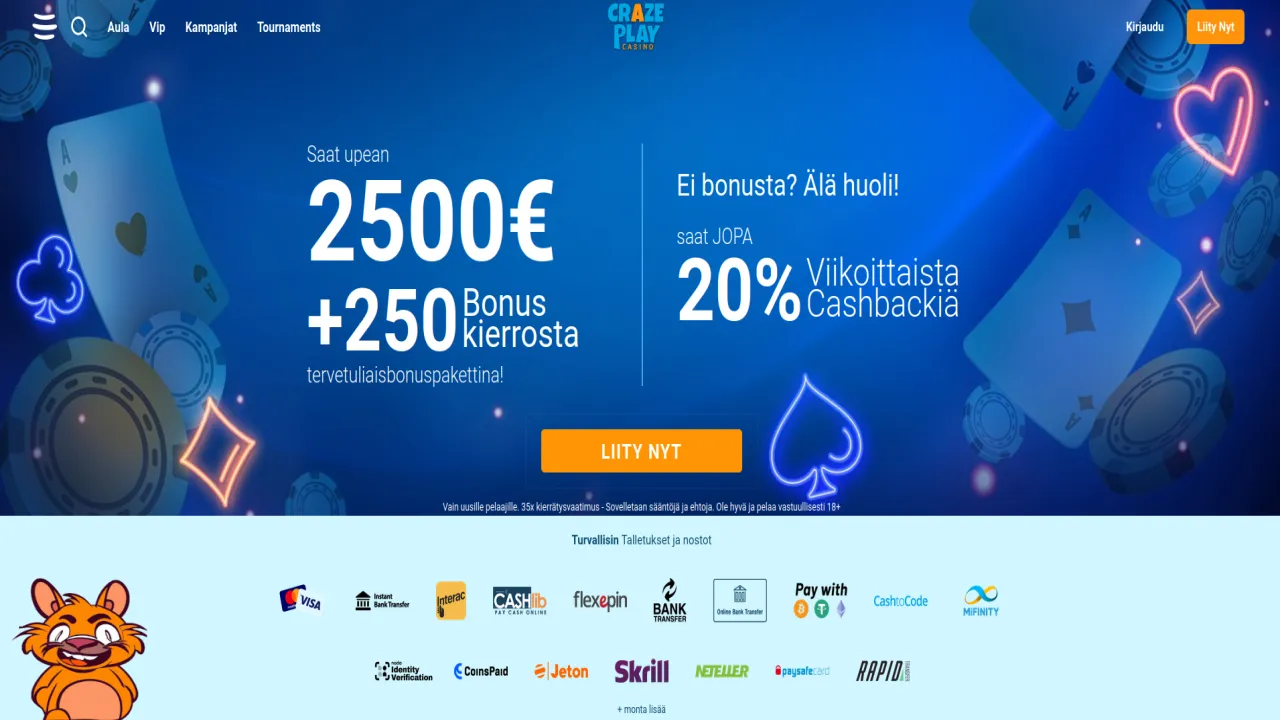

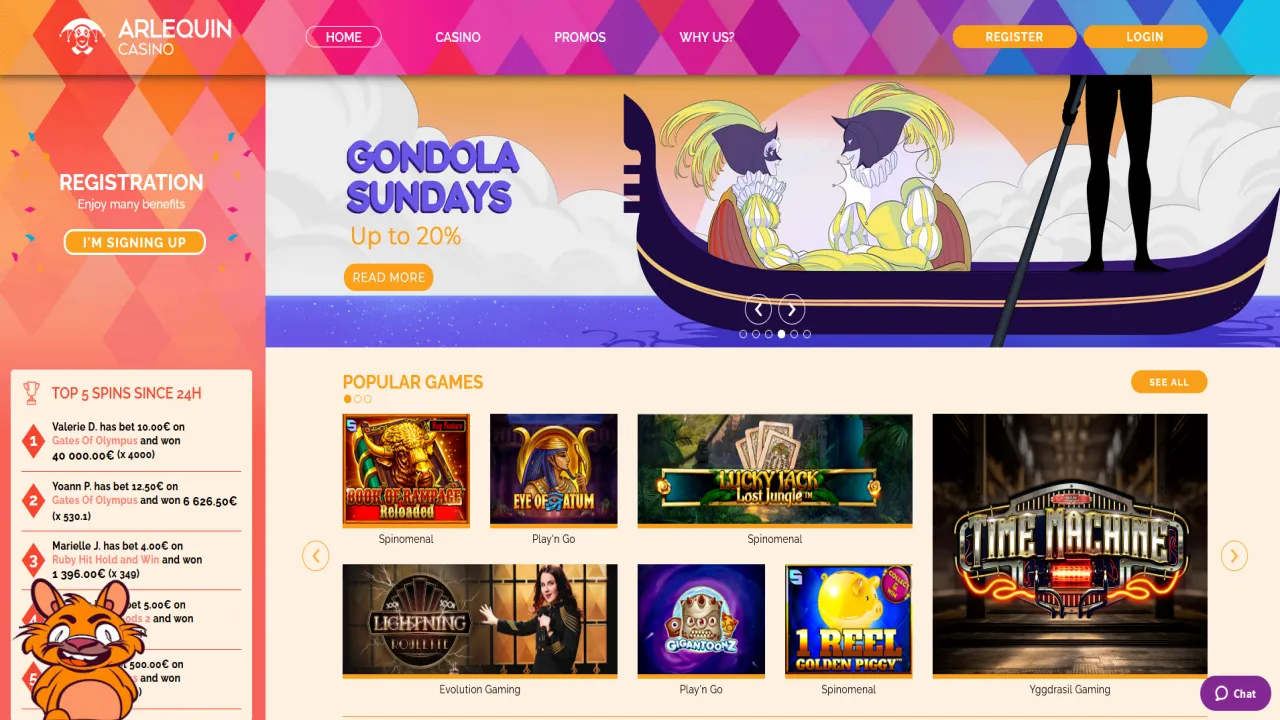

The significance of accurate financial reporting extends beyond traditional businesses to include online casinos and game providers. Popular names like MyEmpire and Neon54 are all affected. For these online platforms, consistency in reporting revenues and adhering to local tax laws is not only a legal obligation but also a reputational safeguard.

Integrating Best Practices for iGaming Companies

iGaming operators and platforms, including those listed on CasinoALMA, must stay vigilant. The need for robust financial oversight cannot be overstated. Accounting professionals within the industry urge these entities to adopt comprehensive auditing practices and transparent reporting mechanisms to avoid potential legal ramifications.

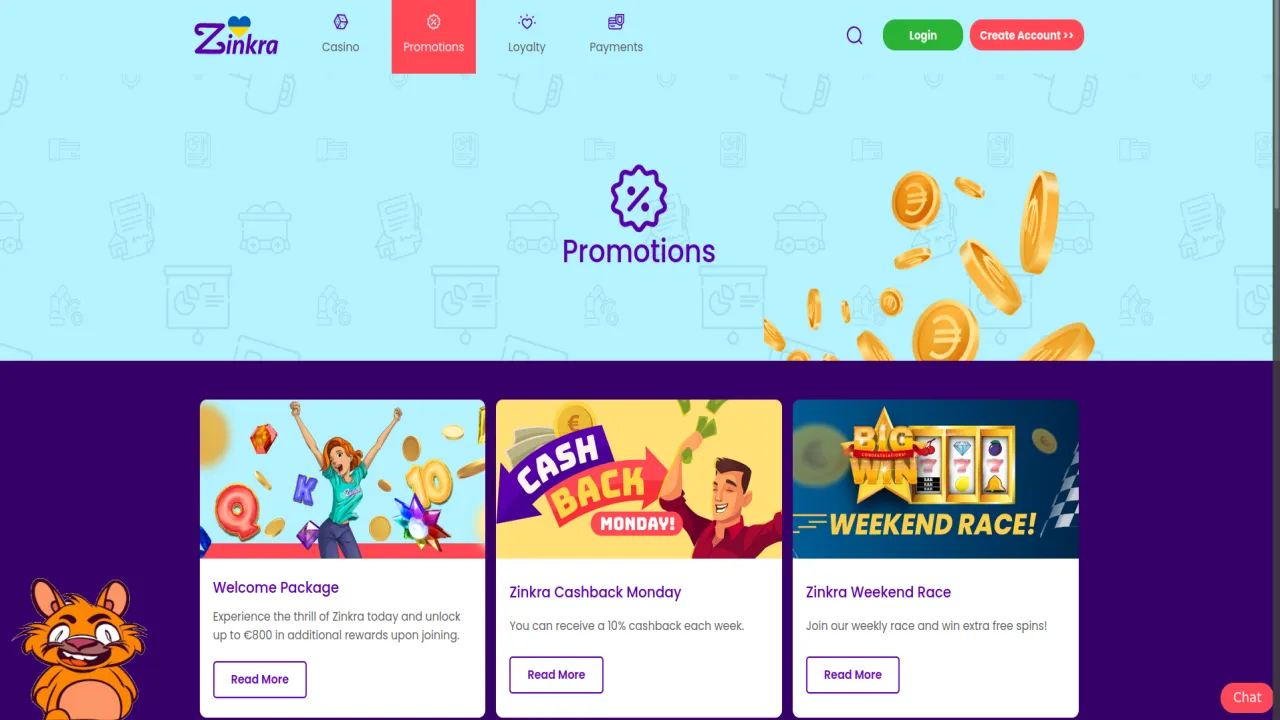

Spotlight on Compliance: A Case for Customer Support

In light of the increasing scrutiny from tax authorities, companies in the iGaming sector must also focus on reinforcing their customer support systems. Addressing financial inconsistencies promptly not only helps in ensuring compliance but also fosters trust among users and regulators. Platforms with robust customer support systems, like Slotspalace and Azur Casino, serve as prime examples in this regard.

Expert Opinions and Legal Perspectives

Legal experts within the iGaming industry have pointed out that adherence to stringent reporting guidelines is non-negotiable. As highlighted by the BIR Commissioner, discrepancies in reported income and property values invite severe penalties. Therefore, companies should consider engaging legal advisors to navigate the complexities of tax compliance. Practitioners specializing in the gambling and casino sectors can provide indispensable insights to help companies maintain proper records.

The Role of Technology in Ensuring Compliance

Technological advancements play a crucial role in helping iGaming platforms comply with regulatory requirements. Utilizing advanced accounting software, automated auditing processes, and integrating blockchain technology can help in maintaining accurate records and generating reliable financial reports. By leveraging these technologies, platforms like CasinoFriday stand as stalwarts in showcasing transparent financial dealings.

BIR's Ongoing Investigations into Tax Evasion

The Bureau of Internal Revenue (BIR) is conducting its own investigation into Bamban, Tarlac Mayor Alice Guo, in parallel with the ongoing Senate inquiry, for possible tax evasion cases. In a statement on Friday, BIR Commissioner Romeo Lumagui Jr. has ordered the agency to have 100% cooperation with the ongoing Senate probe against Guo. Lumagui tasked the taxman’s revenue officers to look into the names and entities who appeared during the hearings.

“The BIR will also conduct its own investigation against the said individuals and entities. Due process will be followed. If the income declared with the BIR does not match the value of the properties amassed during the same taxable years, criminal cases for tax evasion will be filed,” added Lumagui. The BIR chief noted that the same charges can be filed against conspirators and the corporate officers of the companies used to amass such wealth.

Image illustrating 'Tax Compliance in the iGaming Industry'. Professionals engaged in auditing and financial reporting tasks, with a large screen showing complex financial data. Subtle gaming elements in the background represent casinos like MyEmpire and Neon54.

Further Implications of BIR’s Findings

The BIR is also closely monitoring the Senate investigation into Guo. The cash, properties, and other sources of wealth shown during the senate hearings should be substantiated with proper payment of taxes, the tax collection agency said. Senate Deputy Minority Leader Risa Hontiveros, who has been leading the investigation, echoed this sentiment, emphasizing the importance of transparency and the proper documentation of assets.

Moreover, during the last hearing, it was pointed out that the declared income of the Guo Companies was not commensurate with Mayor Alice Guo's assets and investments. This highlighted a potential for undeclared external sources of income. Legal experts within the iGaming industry have pointed out that adherence to stringent reporting guidelines is non-negotiable. As highlighted by the BIR Commissioner, discrepancies in reported income and property values invite severe penalties.

Technological Solutions for Accurate Financial Reporting

To prevent such issues, iGaming platforms are encouraged to adopt technological solutions that aid in accurate financial reporting. The implementation of advanced accounting software can streamline the auditing process and ensure transparency. Additionally, blockchain technology, which offers a high degree of data integrity and immutability, can be invaluable in maintaining trustworthy records.

For instance, platforms like CasinoFriday are utilizing these technologies to maintain transparency and accuracy in their financial dealings. This not only helps in compliance but also builds trust with their users and regulatory bodies.

Case Study: Implementing Best Practices in iGaming

One notable case is that of MyEmpire, an online casino that has set a benchmark for financial transparency. By integrating comprehensive auditing practices and ensuring that their financial reports are accurate and consistent, MyEmpire has managed to avoid any legal ramifications and maintain a good standing with tax authorities.

Similarly, Neon54 has invested in state-of-the-art accounting software that allows for detailed and accurate financial reporting. This ensures that their reported incomes align with their accumulated property values, thereby avoiding any potential discrepancies that could lead to tax evasion charges.

The Importance of Customer Support in Ensuring Compliance

Customer support systems also play a pivotal role in maintaining compliance. When users report financial discrepancies or raise queries related to transactions, a robust customer support system can address these issues promptly, ensuring that they do not escalate into larger problems. Platforms such as Slotspalace and Azur Casino are prime examples of how effective customer support can aid in compliance.

The Broader Impact on the iGaming Industry

The scrutiny from tax authorities extends beyond individual companies to the entire iGaming industry. As more countries adopt stringent tax regulations, platforms that fail to comply face severe penalties. This underscores the need for iGaming companies to not only adhere to local tax laws but also to implement best practices in financial reporting.

For companies in the iGaming sector, the message from the BIR is clear: accurate financial reporting is not optional. It is a critical component of doing business that can affect a company’s legal standing and reputation. The actions taken by the BIR serve as a reminder that regulatory bodies worldwide are keeping a close watch on the industry.

CasinoALMA: Your Go-to Source for iGaming Industry News

As the leading online casino database, CasinoALMA continues to provide its readers with the most up-to-date and reliable news. To stay informed about the best online casino reviews, no deposit bonus deals, and the latest happenings in the iGaming industry, keep an eye on CasinoALMA’s extensive news section.

From trusted reviews to the most lucrative bonus offers and the hottest updates in online gambling, CasinoALMA remains your number one resource. Whether you are looking for insights on game providers like NetEnt, Playtech, or exciting daily free spins opportunities, CasinoALMA has got you covered.

Conclusion: Moving Forward with Integrity

In conclusion, the iGaming industry must heed the call for rigorous adherence to transparent financial practices. With the BIR setting clear expectations, companies must take proactive steps to safeguard their operations from potential legal action. Fortified by technology and strategic guidance, iGaming platforms can navigate the complexities of tax compliance effectively. The journey towards sustainable success in the online gambling realm hinges on these foundational pillars of integrity and accountability.

As the leading source of iGaming news and reviews, CasinoALMA remains committed to providing industry professionals and enthusiasts with the latest updates, ensuring that they stay informed and compliant. For more news and updates, visit CasinoALMA and stay ahead in the ever-evolving world of online gambling.

In the highly competitive landscape of iGaming, platforms like Neon54 and MyEmpire illustrate the critical importance of tax compliance. These platforms have set benchmarks for others in the industry to follow, ensuring that they remain on the right side of the law while maintaining user trust and credibility.